Top 10 Best Real Estate to Invest in Abuja: Prime Estates & Fast-Developing Areas 2025

Nigeria’s capital city is a goldmine for real estate investors. Whether you’re looking for luxury properties, emerging opportunities, or the best place to buy land in Abuja, the city offers diverse investment options that deliver exceptional returns.

At Sendzira, we help diaspora Nigerians navigate property investment from abroad, connecting them with trusted experts and managing assets back home. We understand that investing in Abuja real estate requires expert guidance and reliable local support. Let’s explore the top areas where your investment dollars work hardest.

Why Invest in Abuja Real Estate?

Abuja’s real estate market stands out for several compelling reasons. The city continues experiencing rapid urbanization, with infrastructure development, government projects, and population growth driving property values upward. Investors who buy now position themselves perfectly for significant appreciation over the next 5-10 years.

Key investment drivers:

Federal government presence ensures stable demand

Continuous infrastructure development and road networks

Rising population seeking quality housing

Tech hub emergence attracting young professionals

Competitive rental yields (8-12% annually)

Appreciation rates outpacing inflation

Currency hedge for diaspora investors

The Top 10 Best Areas to Invest in Real Estate in Abuja

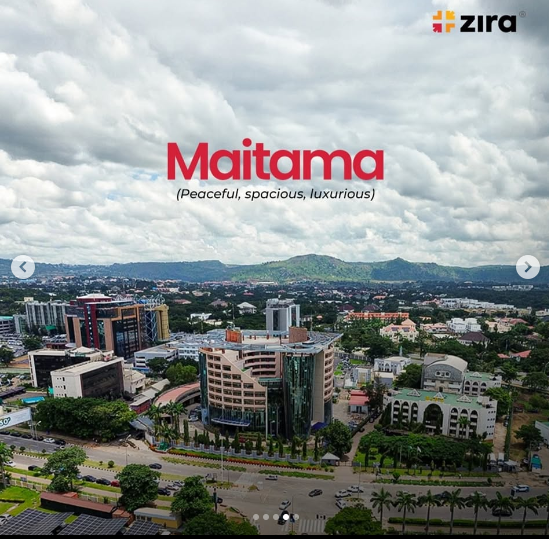

1. Maitama: The Luxury Crown Jewel

Which estate is the best estate in Abuja? For high-end investors, Maitama remains unmatched. This ultra-premium residential district hosts government officials, corporate leaders, and international dignitaries.

Investment highlights:

Average land prices: ₦4 billion+ for large plots

Luxury apartments: ₦150-500 million

Exceptional rental demand year-round

Strong capital appreciation

Premium infrastructure and security

Perfect for diaspora investors seeking prestige

Why it ranks highest: Maitama’s established reputation and limited supply ensure sustained value growth. While entry costs are high, rental yields justify the investment.

2. Guzape: The Emerging Powerhouse

Guzape 2 is emerging as one of the most desirable areas for real estate investment in Abuja, with strategic infrastructure developments making it a fast-developing area in Abuja.

Investment highlights:

Competitive pricing compared to Maitama

Rapid infrastructure development

Government attention and improvements

Growing expat community

Excellent appreciation potential

Mix of established and new properties

Why investors love it: Guzape offers the sweet spot between premium location and growth potential. Properties here appreciate faster than established areas.

3. Gwarinpa: Affordable Growth Opportunity

Seeking cheap real estate to invest in in Abuja? The average price of land for sale in Gwarinpa, Abuja is ₦160,000,000, with prices ranging from ₦18,000,000 to ₦50,000,000,000.

Investment highlights:

Gwarinpa is the last district in the Abuja Municipal Area Council and in the phase 3 development plan of Abuja

Affordable entry prices for bulk land purchases

High demand from first-time homebuyers

Strong rental market for middle-income families

Rapid value appreciation year-over-year

Perfect for developers and portfolio builders

Why it’s smart investment: Gwarinpa combines affordability with genuine growth potential. As surrounding infrastructure improves, property values multiply.

4. Asokoro: Premium Strategic Location

Asokoro offers luxury properties within Abuja’s real estate market, making it ideal for discerning investors.

Investment highlights:

Presidential villa proximity adds prestige

High-net-worth individual concentration

Stable, appreciating property values

Excellent security infrastructure

Strong diplomatic and government tenant base

Premium rental rates (₦8-15 million annually)

Why it matters: Asokoro’s strategic location near power centers ensures consistent demand and impressive rental yields.

5. Katampe Extension: The Fast-Developing Area

Which area is fast developing in Abuja? Katampe Extension showcases rapid transformation with new infrastructure connecting it to other premium areas.

Investment highlights:

Strategic location between established areas

New road networks improving accessibility

Growing commercial activity

Affordable compared to neighboring premium zones

Strong potential for 300-400% appreciation

Mixed-use development opportunities

Why watch it closely: Katampe Extension combines current affordability with genuine fast-developing potential, perfect for growth-focused investors.

6. Wuye: The Balanced Investment

A best area to invest in real estate, Wuye offers balance between accessibility, pricing, and growth potential.

Investment highlights:

Wuye is part of Abuja’s diverse real estate market with properties at various price points

Mixed commercial and residential development

Excellent transportation connectivity

Growing young professional population

Reliable tenant base

Moderate appreciation with steady returns

Why investors choose it: Wuye provides predictable returns without extreme price volatility, ideal for conservative investors.

7. Jabi: Emerging Tech Hub Potential

Jabi stands out for its growth prospects and strategic advantages as a fast-developing area in Abuja with emerging business opportunities.

Investment highlights:

Tech startup concentration growing rapidly

Young professional demographic

Entertainment and commercial development

Increasing rental demand

Affordable entry prices

Future appreciation potential as tech hub grows

Why it’s promising: Jabi’s emerging status as a tech hub positions it for significant growth as more businesses relocate to this area.

8. Lokogoma: Affordable Quality Investment

Lokogoma stands out for growth prospects among fast-growing neighborhoods to invest in real estate in Abuja 2025.

Investment highlights:

Among the cheapest real estate to invest in in Abuja

Rapidly improving infrastructure

Growing school and healthcare facilities

Family-oriented community development

Strong demand from middle-income buyers

Exceptional rental market for young families

Why budget-conscious investors win: Lokogoma delivers affordable entry prices with genuine infrastructure improvements driving appreciation.

9. Lugbe: Industrial & Commercial Growth

Lugbe offers strategic advantages as a fast-developing neighborhood for real estate investment, with mixed residential-commercial potential.

Investment highlights:

Industrial zone proximity creates business opportunities

Commercial development accelerating rapidly

Affordable land prices

Growing logistics hub relevance

Strong business tenant base

Commercial rental yields outpacing residential

Why developers love it: Lugbe’s commercial orientation creates diverse investment opportunities beyond traditional residential play.

10. Apo: The Hidden Gem

Often overlooked, Apo represents where the best real estate to invest in might be hiding, offering excellent value for patient investors.

Investment highlights:

Significantly undervalued compared to neighboring areas

Government projects underway

Road network improvements planned

Future appreciation potential substantial

Lower competition from other investors

Ideal for long-term hold strategies

Why savvy investors watch it: Apo’s current undervaluation combined with planned infrastructure makes it a classic value investment opportunity.

Where Is the Best Place to Buy Land in Abuja?

The answer depends on your investment strategy:

For maximum appreciation (5-10 years): Guzape, Katampe Extension, or Jabi For immediate rental income: Maitama, Asokoro, or Wuye For affordable bulk purchases: Gwarinpa, Lokogoma, or Lugbe For long-term wealth building: Any area with C of O and government recognition For diaspora investors: Maitama or Guzape (easier to rent out and manage remotely)

Top 10 Real Estate Investment Strategies for Abuja

1. The Flipping Strategy

Buy undervalued properties, improve, and sell within 2-3 years. Gwarinpa and Lokogoma offer excellent flipping opportunities.

2. The Rental Income Strategy

Purchase in high-demand areas like Maitama or Wuye, achieve 8-12% annual yields while building long-term appreciation.

3. The Land Banking Strategy

Buy land in fast-developing areas like Katampe or Lugbe, hold for 5+ years as infrastructure drives appreciation.

4. The Commercial Strategy

Invest in mixed-use developments in Jabi or Lugbe for higher commercial rental yields (15-20% potential).

5. The Portfolio Diversification

Invest across 3-4 different areas with varying risk profiles to balance portfolio performance.

How to Start Investing in Abuja Real Estate from Abroad In Steps

1: Research & Due Diligence Understand each area’s growth trajectory, infrastructure plans, and property values.

2: Legal Documentation Ensure property has Certificate of Occupancy (C of O), not just Deed of Assignment.

3: Engage Local Experts Partner with trusted agents, lawyers, and consultants who understand the market.

4: Secure Financing Explore mortgage options or structured investment plans.

5: Complete Transactions Remotely Many transactions can be completed with power of attorney arrangements.

Red Flags When Investing in Abuja Real Estate

Properties without proper C of O documentation

Prices significantly below market rates (potential fraud)

Sellers rushing transactions without proper procedures

No clear title history or ownership chain

Properties in disputed land areas

Developers without verifiable track records

Market Insights: Abuja Real Estate Pricing (July 2025)

Land Prices by Area:

Maitama: ₦4-10 billion (large plots)

Asokoro: ₦1.5-4 billion

Guzape: ₦800 million – ₦2 billion

Katampe: ₦600 million – ₦1.5 billion

Gwarinpa: ₦160 million average (₦18M-₦50B range)

Wuye: ₦300 million – ₦1 billion

Jabi: ₦250 million – ₦800 million

Lokogoma: ₦150 million – ₦600 million

Lugbe: ₦200 million – ₦700 million

Apo: ₦100 million – ₦400 million

Expected Annual Appreciation: 8-15% across most prime areas

How Sendzira Simplifies Real Estate Investment Management

Managing property in Abuja while living abroad requires trusted local support. Sendzira connects diaspora Nigerians with verified real estate professionals and handles property management logistics.

Our real estate services include:

Property Search & Analysis: Expert guidance on which estates offer best value

Due Diligence Support: Connecting you with verified lawyers and agents

Document Management: Secure handling of property documents and C of O

Tenant Coordination: Managing tenant relationships and rental payments

Property Maintenance: Coordinating repairs and upkeep

Legal Compliance: Ensuring property tax payments and registrations stay current

Remote Transaction Support: Power of attorney arrangements for purchases

Whether you’re exploring top 10 real estate to invest in in Abuja or seeking the best estate in Abuja for your specific goals, we provide the local expertise and reliable partnership you need.

Ready to invest in Abuja real estate from anywhere in the world?

Call/WhatsApp: 0809 100 0036

Email: info@sendzira.com

Let Sendzira be your trusted partner in Abuja real estate investment. We bridge the distance between your investment goals and ground-level execution, ensuring your property decisions succeed from thousands of miles away.